One could reasonably assume, given the growing presence of digital broadcasting platforms across the continent, that Africa is stepping away from the sidelines of the sports streaming economy. In this feature, we unpack the ongoing transformation of sports consumption across the continent and examine the broader commercial ecosystem driving that change.

Key insights explored:

- Market growth and value: An analysis of the MEA region’s sports streaming market size, including projections and Africa’s increasing share.

- Platform strategies: A close look at the continent’s major players — Showmax, SuperSport, FIFA+, NBA League Pass, YouTube — and their competitive positioning.

- Monetisation models: Insight on subscription tiers, ad revenue, and how economic disparity affects pricing capacity.

- Structural challenges: The impact of high Internet costs, uneven broadband penetration, and intricate content rights contexts.

- Opportunities ahead: What the future holds for new entrants.

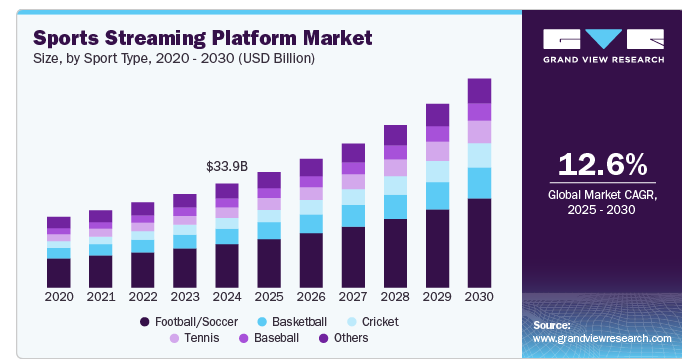

According to a report by Grand View Research, a market research and consulting company, the global sports streaming market, valued at $33.93 billion in 2024, is expected to increase to $68.3 billion by 2030 at a CAGR (2025-2030) of 12.6%.

The Middle East and Africa’s (MEA) sports streaming market generated $1.283 billion in 2024, with a projected 11% compound annual growth rate (CAGR), taking it to $2.379 billion by 2030. This puts the MEA quota at roughly 3.8% of the global revenue. While still trailing continents such as North America and Europe by wide margins, Africa’s numbers, to which South Africa contributes $253.2 million, highlight key momentum.

Traditional television still retains its appeal for major sporting activities, but the migration toward on-demand, flexible viewing options is gradually spreading across the continent. This shift from TV platforms to digital options is very obvious. A case in point is Showmax’s introduction of a standalone mobile-only English Premier League (EPL) package across over 40 countries in January 2024, delivering every match straight to smartphones — a first for Africa.

This rollout coincided with a broader service. Showmax relaunched in February 2024, and with the backing of stakeholders — MultiChoice (70% stake) and NBCUniversal (30% stake) — the platform set off a five-year target of $1 billion in revenue and 50 million subscribers. It earned roughly $54 million in the 2024 fiscal year, a 22% increase year-over-year, despite incurring a significant loss of R2.6 billion ($140.5 million) during the same period.

The NBA has also expanded its digital presence in Africa, with its Kenya and South Africa platforms now offering localised streaming services, including live games, Afro-centric shows, and more via mobile apps.

Football is not left out, with CAF TV launched on YouTube to make full matches and highlights from continental tournaments available for streaming directly to viewers.

Major players on the continent

Showmax and SuperSport

In November 2023, Showmax (2.1 million subscribers) overtook Netflix (1.8 million subscribers) to become the continent’s leading subscription-video-on-demand (SVOD) platform. What has proven pivotal in this achievement is the platform’s shift toward sports content, through which it has introduced the first freestanding mobile EPL service in Africa, delivering all 380 games live to subscribers.

This streaming feature is powered by SuperSport, a major player in African TV sports broadcasting for over two decades that has reached millions of homes across the continent through the DStv platform. At AFCON 2024, SuperSport accounted for 3.7 million viewers, representing 16.5% of the continent-wide total of 22.3 million viewers.

Per SuperSport, the semi-final fixture featuring Nigeria and South Africa “set new records and captured the imagination of a total unique audience of 10.3 million viewers…on SuperSport and SABC platforms.”

While digital streaming is on the rise, SuperSport’s control of major rights and top-value ad slots makes it a strong traditional and hybrid player for monetised sports viewership. The platform now has its streaming app, officially launched in October 2020, though its video rights only cover sub-Saharan Africa.

FIFA+ & NBA League Pass

FIFA’s digital platform, FIFA+, enables football fans worldwide to stream live matches, replays, and original films related to the sport. Viewers also get access to the FIFA World Cup archive, which is available in multiple languages. Coverage does not exclude African audiences, who can watch the continent’s major football games, as well as youth and women’s tournaments.

The NBA League Pass is the NBA’s subscription streaming service, providing users with access to live and on-demand games throughout the entire season. Regular season matches that may not appear on national channels are broadcast to users in the US and internationally. The League Pass services in Kenya and South Africa now feature localised content, a reflection of the basketball association’s recognition of the continent and its digital consumption potential.

In 2023–24, NBA Africa achieved a 41% YoY increase after recording over six million hours on the continent. The Association’s social video output also skyrocketed, with 90 million views, as its YouTube page experienced a 230% increase in engagement. These accomplishments were particularly driven by regionalised content and events like the All-Star Africa Takeover. In 2025, Africa’s basketball media market is projected to generate $38.4 million, with an average revenue per user (ARPU) of $5.25 — one of the highest returns per user in digital sports in the region.

YouTube

YouTube is the most popular video streaming platform due to its ability to offer a wide range of visual content — including sports-related videos — without subscription barriers.

CAF’s collaboration with YouTube for free, global distribution of African tournaments indicates an acceptance of direct-to-consumer (DTC) platforms, which sidestep priced broadcast arrangements. This framework expands access, particularly for low-income regions where satellite or cable coverage is limited.

While YouTube is unrivalled for open access and virality, platforms like NBA League Pass and SuperSport show that subscription and hybrid models still drive a significant portion of revenue. YouTube’s utility in the sports industry is anchored more on exposure than monetisation — important for federations like CAF, but limited for those seeking direct returns.

Pricing model

Subscription-based strategies

The Showmax subscription model, like most, is a tiered one, offering different levels of sports service at varying costs, including one for the EPL service.

The platform acknowledges football’s immense global engagement. According to a 2024 market study, football streaming accounted for a 29.87% share of the global live sports streaming market in 2022. This highlights Showmax’s strategic focus on football as a commercially smart move, well-attuned to both international and African viewer preferences.

However, African markets face certain unique issues that make implementing streaming subscription models like Showmax’s difficult. Disposable income varies dramatically across the continent, both between countries and economic classes, leading to a situation where only a fraction of the overall population can afford to continue subscribing. Platforms must now ensure that premium content is offered within affordable pricing structures that appeal to local markets.

Advertising revenue streams

Traditional advertising remains a pillar on the continent, particularly for free-to-access content, and is expected to continue growing in Africa’s media economy. PricewaterhouseCoopers (PwC’s) Africa Entertainment & Media Outlook 2024–2028 report shows that broadcast TV advertising revenue in South Africa will reach R6.9 billion ($392 million) in 2028, despite the pressure from video streaming services. This forecast indicates the persistence of linear television, even as audiences continue to shift toward mobile and on-demand consumption.

A key motivation behind this persistence is sports programming. Live sports are unlike other content where time can be manipulated, shifted, or skipped. Instead, they preserve the appeal for viewing based on appointments, making them a pull for marketers seeking real-time audience engagement.

SuperSports continues to drive growth in sports-related advertising revenue. For example, ad earnings across South Africa surged by 3% in 2024, majorly aided by the coverage of the Olympics, Euro 2024, cricket, and rugby.

Traditional players benefit from peak-time advertising windows and uninterrupted subscriptions, such as DStv, while digital platforms monetise through targeted in-stream ads and mobile accessibility.

Challenges to overcome

High data costs in some markets

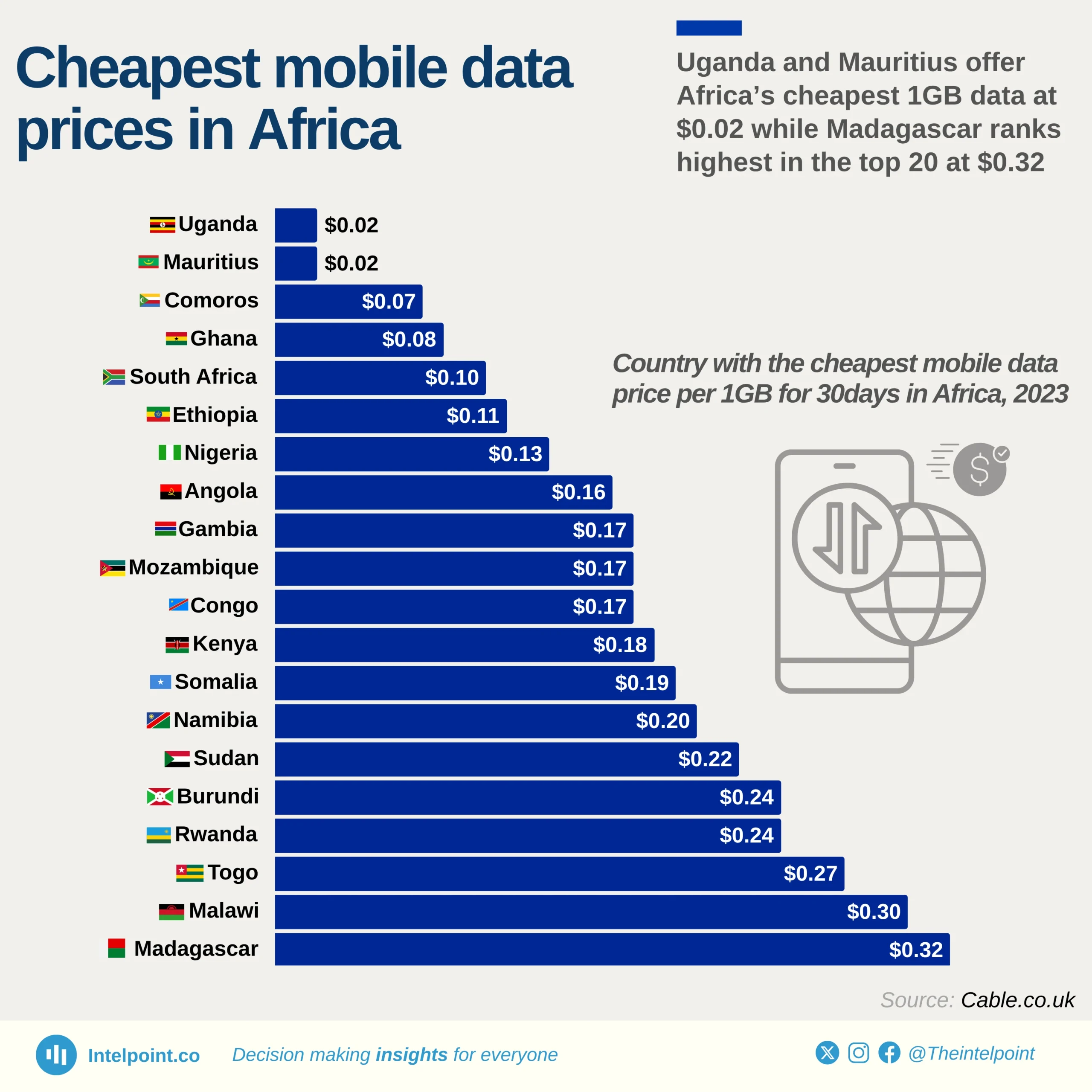

Despite the gradual uptrend in mobile penetration rates, streaming accessibility remains hampered across several African regions where the cost of sustained data usage may prove burdensome for the average consumer.

In 2023, 1 GB of mobile data cost less than $1 in 20 select African countries, and watching a 90-minute football match in HD in Nigeria ($0.13) required 2 to 3 GB. According to the Alliance for Affordable Internet (A4AI), data can be considered affordable when 1 GB costs less than 2% of monthly income. In much of sub-Saharan Africa, even with declining rates, data still exceeds the affordability threshold for the majority of the population, making video streaming an occasional indulgence rather than a routine activity.

Economic disparities

The economic diversity on the continent affects monetisation strategies. Premium subscription packages that function in South Africa — a region possessing higher GDPs per capita, as of the time of writing — may be out of reach for consumers in Nigeria, where GDP per capita is considerably lower. Platforms are then required to develop region-specific pricing systems and payment methods.

Content rights complexity

Another challenge is securing sports broadcasting rights. There are several factors that platforms must get through, such as national regulations, licensing protocols, and varying content exclusivity rules. Additionally, international rights — such as those for the EPL or NBA — are high-priced and extremely competitive, offering limited access for smaller or developing platforms.

A new era for sports consumption?

The streaming wave sweeping through African sports is a reflection of the continent’s technological progress. On the other hand, it signals evolving consumer preferences amongst Africa’s youth-dominated population.

Among digital-first players, NBA League Pass has a scalable, youth-focused engagement, while Showmax is best positioned for mobile bundling and mass growth. Straddling the domains of traditional media and digital services, SuperSport remains the volume leader in appointment sports content and ad income.

Over time, as infrastructure improves, digital payment systems expand, and competition intensifies, it will be interesting to see whether international names — like ESPN+, Amazon, Hulu, and DAZN — will enter the fray and become major stakeholders in the continent’s sports streaming market.