When a young African footballer signs with a European club, it’s often hailed as a victory for the player, the family, and the continent. But behind that deal lies a much deeper and murkier reality: one where the biggest winners aren’t always those who kicked the ball, trained the talent, or built the dream. Instead, they’re often offshore brokers, foreign agents, and middlemen with little emotional investment in the African game.

While Africa produces the talent, others pocket the profit. This isn’t just about football; it’s about the billions leaving the continent with every transfer and the local communities left behind. To understand African football, you have to follow the money and ask why it’s rarely coming back home.

Africa’s football transfers produce some of the world’s most gifted players. From the dusty pitches of Lagos to the neighborhood fields of Accra and the academies of Dakar, the continent is overflowing with talent. But for all its abundance, the business of moving that talent abroad is often exploitative, unclear, and imbalanced.

The road to Europe isn’t straight or fair; it never was! In most parts of Africa, a young footballer’s journey typically begins in a local football club or academy that is often not licensed and lacks backing from national federations. These academies, many of them privately owned, are typically the first institutions to “invest” in a player. They sometimes feed, train, house, and showcase them in local and international tournaments.

The hidden “middlemen”: Agents, offshore accounts, and proxy clubs

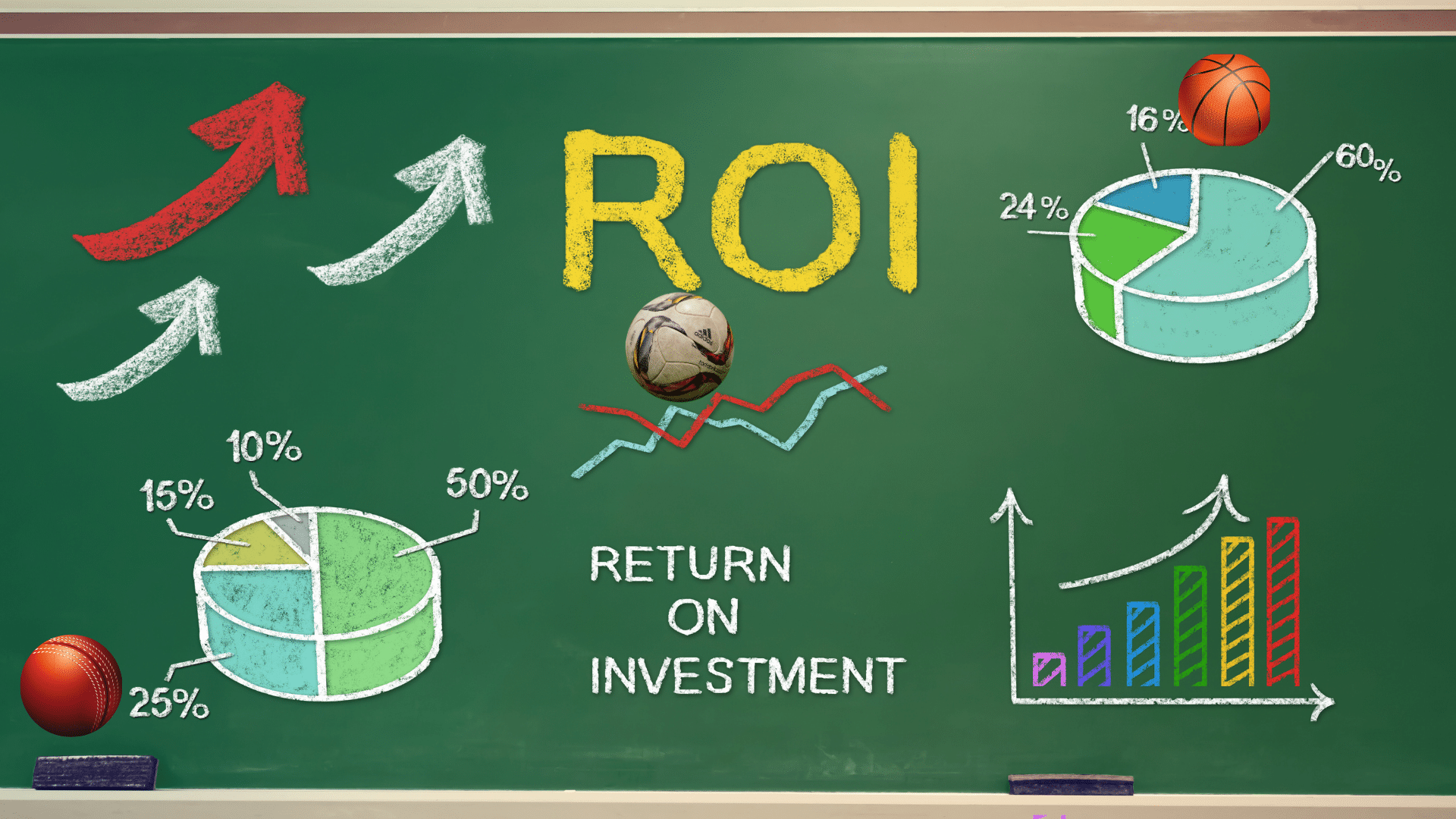

According to the FIFA Global Transfer Report 2023, published in January 2024, Nigeria and Ghana emerged as leading exporters of football talent on the global stage. Nigeria recorded 825 international player transfers worth $189.1 million, while Ghana registered 630 international transfers worth $162.9 million. Across the continent, CAF recorded 2,126 transfers internally and 3,066 transfers outside the continent, resulting in a net profit of only $58.5 million.

These figures highlight Africa’s growing export prowess, with clubs increasingly benefitting from outbound deals, but also underscore the uneven spending in player acquisitions and most importantly net revenue that comes to the clubs, players, and the federation, indicating that while Africa is a net exporter of talent, most of the financial value is channeled abroad to hidden middlemen (agents, offshore accounts, and proxy clubs).

“Unless you have a formal European partnership, you’re invisible in the room where deals happen,” said Mamadou Faye, an academy director in Dakar who has seen his players move abroad for years with little recognition or compensation.

Speaking about the sharing formula often adopted, he further revealed that a typical €500,000 transfer of a young African player to a European club is not as life-changing as it is often perceived to be for the player and the local agents.

Typically, 40–60% of the fee is allocated to the European club or intermediary, 15–20% is retained by agents as commission (often split among several parties), and 20–30% may end up in offshore accounts managed by holding companies involved in the deal. The African academy or grassroots club that discovers and trains the player is often left with nothing, or at best, 5%, if they are registered and recognised.

A Nigerian academy owner took to social media in 2022 to vent his frustration over the transfer of one of his star pupils. “He signed for a top club, but we didn’t see a kobo,” he wrote, reflecting on the transfer of his player, whose signing-on fee, he claimed, triggered international headlines but zero reward for the people who developed him.

And it’s not just grassroots institutions getting cut out; sometimes, even the players themselves are vulnerable. Speaking to Complete Sports in September 2020, Andrew, Victor Osimhen’s older brother, said, “If Victor had signed the contract papers written in Italian language, he would have signed himself to slavery as the agent and his crew will be making serious money while my brother will earn peanuts.”

The commoditisation of talent

Interestingly, despite Osimhen’s caution before his record-breaking move from Lille to Napoli in 2020, the deal was not what it seemed. Initially reported as a €70 million deal, further investigations revealed that it was structured in a way that inflated the value through the use of fringe player swaps and padded commissions.

Reports from French media suggested the real cash value was closer to €36 million. Intermediaries walked away with multi-million-euro cuts, but the Lagos-based academy that raised Osimhen, although recognised, received far less than expected.

In an interview with France Football, Jean-Gérard Benoit Czajka, a former agent of the player, shed some light on what went on behind the scenes.

“Luis Campos [then Lille’s sporting director] and Gérard Lopez [then Lille’s owner] contacted me by phone, strongly recommending that I negotiate with this new agent, otherwise, according to them, I risked losing everything.”

A report published by the Journal of Ethnic and Migration Studies highlights how African players are routed through intermediary clubs in countries like Belgium, Slovakia, and Cyprus; these are usually clubs with minimal league impact but strong agency networks. These “stepping stone clubs” are not chosen for sporting development but for financial engineering. They navigate around regulations and transfer payments, underscoring systemic issues within transfer pathways.

Per a 2015 BBC investigative report, a minimum of 15,000 teenage footballers are moved out of West Africa every year illegally. The report exposed how agents exploit underage footballers from poor African nations with the promise of playing professional football in Europe’s top leagues.

Speaking about these concerns, renowned anti-trafficking campaigner Jean-Claude Mbvounim shared his displeasure, saying, “Today we have criminal activists threatening world football and the young players, so it’s important to work together. Fifa will have to be on top of this battle.”

Take the case of Souleymane Diarra, a promising midfielder from Ouagadougou. Though scouted by Ligue 1 clubs, his first European contract was with a Slovakian third-tier team, FK Senica, a club known for signing African players in bulk and quickly transferring them out.

Within three months, Diarra was transferred to a French club for €350,000, but his home club in Burkina Faso received only €4,500 as training compensation. The Slovakian club had no intention of developing him; they were a financial vessel, not a football institution.

In reality, the contract was negotiated by an agent with controlling shares in FK Senica. This pattern has been replicated across dozens of cases in Ghana, Cameroon, and the DRC, where proxy clubs act as transfer incubators to inflate or shield the actual financial value of a player.

In Cameroon, several top talents, including U-23 international Alain Moukoko, have been transferred abroad under the radar of national football authorities. A 2022 FIFA report highlighted issues with the recording of outbound player transfers in 2021 within the FIFA Transfer Matching System (TMS). Specifically, some transfers were either not recorded at all or were not properly documented in the system. This lack of proper registration by federations, such as the Cameroonian Football Federation (FECAFOOT), can create complications for clubs, players, and FIFA itself, as the TMS is the official record of international transfers.

Page 37 of the report (under “Training Compensation and Solidarity Mechanism”), FIFA notes that in 2022 alone, out of the approximately 11,139 professional transfers, only about 2,903 were recorded. The report further highlights Cameroon among the top 10 African countries in terms of the number of international transfers. However, Cameroonian clubs rarely appear in the list of training compensation recipients, despite the known role of FECAFOOT in player development.

“Clubs are losing tens of thousands of euros per transfer simply because the deals are disguised as free moves,” said Jean-Louis Mbia, a FECAFOOT legal officer.

According to Mbia, these missing funds are more than administrative failures; they’re lost salaries for coaches, unpaid medical bills for injured players, and evaporated dreams for the next generation of talent. It’s not unusual for grassroots coaches in Africa to operate on monthly stipends of less than $100, while players they’ve trained are sold for six-figure fees abroad.

The European advantage of technology, legal power, and data

The imbalance is not just in transfer deals. African clubs often lack legal support, data infrastructure, and broadcast leverage to monetise their players. In contrast, agencies in Europe utilise advanced player tracking tools, performance databases like Wyscout and InStat, and legal representation to enhance the visibility and market value of African prospects.

Local clubs operating in data silos cannot match this sophistication. “Unless you have a formal European partnership, you’re invisible in the room where deals happen,” said Mamadou Faye, a Dakar-based academy director.

As a result, African clubs often enter negotiations from a position of desperation, not strategy. A Ugandan club executive, speaking anonymously during his revelation, stated that they sold a player for $25,000 because they had a six-month wage backlog. Three weeks later, the player was resold to a club in the Middle East for $400,000.

When African football loses revenue, it doesn’t just hurt local clubs; it also affects national GDP in subtle but measurable ways. According to PwC Nigeria’s 2020 Sports Industry Outlook, the Nigerian football economy could contribute over ₦500 billion annually (approx. $650 million) if talent exports were better regulated and domesticated via clear taxation, equity stakes, and reinvestment.

Instead, much of the value leaks offshore. In fact, a 2022 KPMG report on African talent in European leagues stated that only 2 out of 10 African-origin transfers from top five leagues showed any financial benefit for the parent club, and less than 5% of these involved a formal agent-player representation agreement governed under local law.

Can Africa profit from its talent pipeline?

Recently, a similar issue made headlines in Ghana: a U-20 talent had recently moved to a Scandinavian club. Publicly, it was a free transfer. Privately, a European-based agent was paid €60,000 offshore.

The Ghanaian academy that trained him for five years got nothing. Why? The player had been signed out of Ghana through an agent-owned club in Belgium, a common workaround to avoid solidarity payments.

Senegal, to its credit, offers a better model in some cases. Institutions like Génération Foot have established formal partnerships with clubs such as FC Metz in France. This has allowed them to negotiate clear sell-on clauses, as in the case of Sadio Mané.

When Mané was sold to Liverpool in June 2016 for £34 million, Génération Foot received a share of the fee. However, even in Senegal, smaller academies without European ties remain excluded from the system.

The truth is stark: the African ecosystem is building the product but not banking the profits. European clubs benefit from cheap, high-upside players. Agents and intermediaries, often working through multiple hands, collect commissions at every stage. Offshore entities profit from holding player rights. Meanwhile, African clubs, academies, and even national associations are left with crumbs, if anything at all.

And the players? Some make it. Many don’t. For every Osimhen or Mané, there are hundreds, if not thousands, who get stuck in amateur leagues abroad, lost in paperwork, or forced to abandon the game altogether.

It is safe to say that a big part of the problem lies in regulation. African football federations lack centralised tracking systems for transfers. FIFA’s Transfer Matching System (TMS) is often not fully used or enforced. Many academies are unregistered, meaning they don’t qualify for solidarity payments or training compensation, which are designed to reward clubs that develop talent.

In addition to this, the widespread use of European proxies, which refers to clubs and companies in Europe set up specifically to sign African players and resell them, affects the reward system, and it is a major reason local stakeholders have minimal power in the market they fuel.

The way forward

For Africa to truly benefit from its football economy, several reforms like licensing and monitoring of local academies should be enforced, and federations must mandate the tracking of players and deals.

Additionally, there is a significant need for comprehensive player education, as young African footballers and their families require legal support and education on their rights. There must also be a strong demand for transparent partnerships, with local academies insisting on formal agreements with European clubs, as seen in the cases of Génération Foot and Metz.

Another area that should be seriously promoted is diaspora investment. African investors in the diaspora should consider supporting ethical academies and creating registered sports funds to build the industry from within.

African football isn’t short on talent; it’s short on ownership, transparency, and control. As long as deals are negotiated behind closed doors, in currencies counted in foreign banks, and with contracts signed outside the continent, Africa will continue to lose the wealth created by its own feet. Until Africa claims full ownership of its football value chain, it will keep producing gold, only for others to mine and refine it for its worth.

If Africa fails to reform its football transfer system, it risks remaining a source of raw talent and lost wealth. With billions of dollars in player valuations passing through the continent each year, the potential is enormous. But so are the losses.

Football can and should be a national asset, a revenue stream for governments, a job creator for thousands, and a platform for youth empowerment. The challenge is building systems that protect value, enforce transparency, and keep more of the reward within the ecosystem that creates the talent in the first place.

As renowned South African sports lawyer Modise Mashigo put it, “African football doesn’t need sympathy. It needs sovereignty over its value.”

The next time a transfer headline breaks, don’t just say, “Where is he going?” Ask who’s getting paid and if Africa is winning from the deal, or just watching?