Sports betting brands are emerging across Africa as a major financial backbone of leagues, teams, and related events. This recent spike in betting-affiliated sponsorships has helped reduce the struggles of sporting entities, keeping much of the wider industry afloat.

But while it has done this, it has also raised critical doubts regarding the ethical and regulatory implications of such integration into Africa’s ecosystem. Today, various betting company logos and ads are a feature of the streets, bearing on the daily lifestyles and choices of many.

The scale of the betting invasion

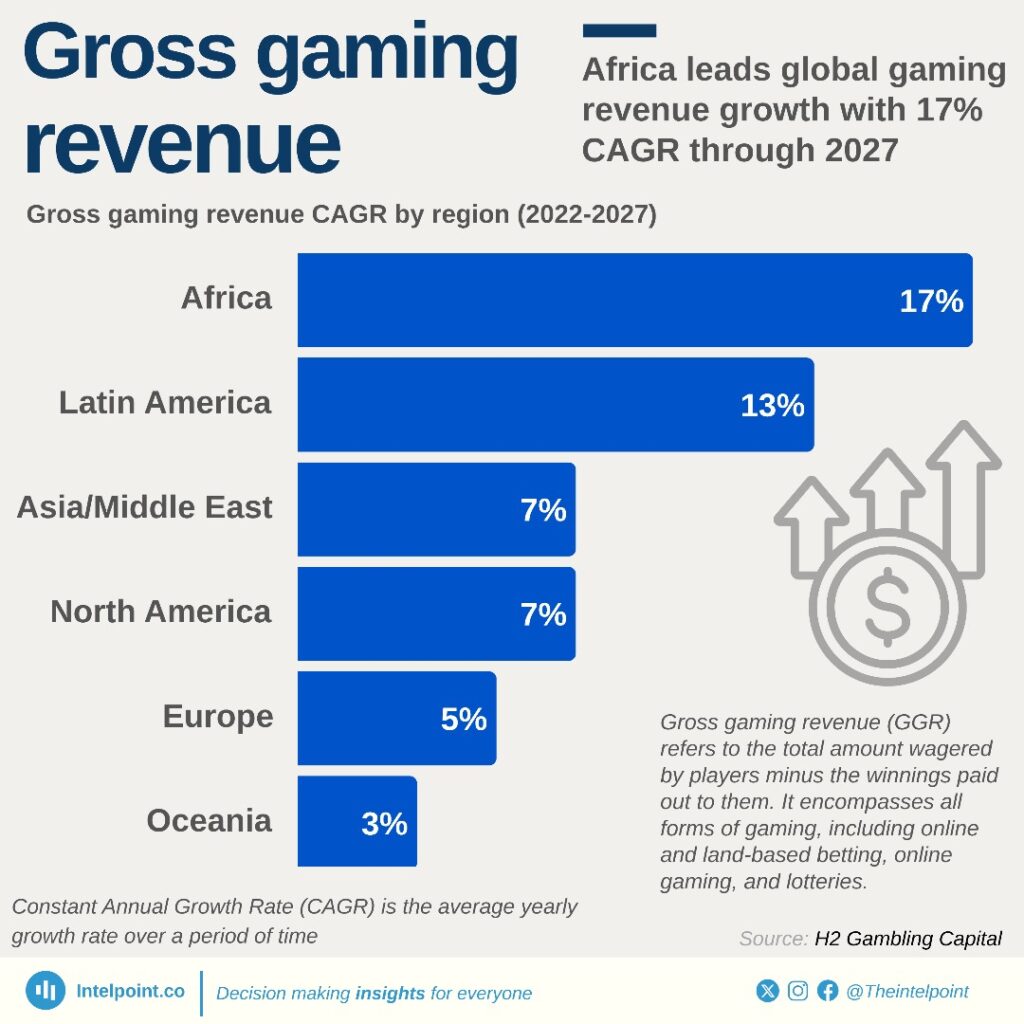

The chart above shows the projected rise in Gross Gaming Revenue (GGR) globally from 2022 to 2027, as measured by Compound Annual Growth Rate (CAGR%).

Africa has the highest CAGR in the world, at an estimated 17%, showing that the continent’s gaming and betting sector is growing faster than others.

Why is Africa expected to grow the fastest?

- Rising mobile and Internet usage

- A young population likely to indulge in Internet gambling and sports betting

- Several countries with relaxed or evolving betting regulations

- Increased betting brand sponsorship of sports teams, leagues, and athletes.

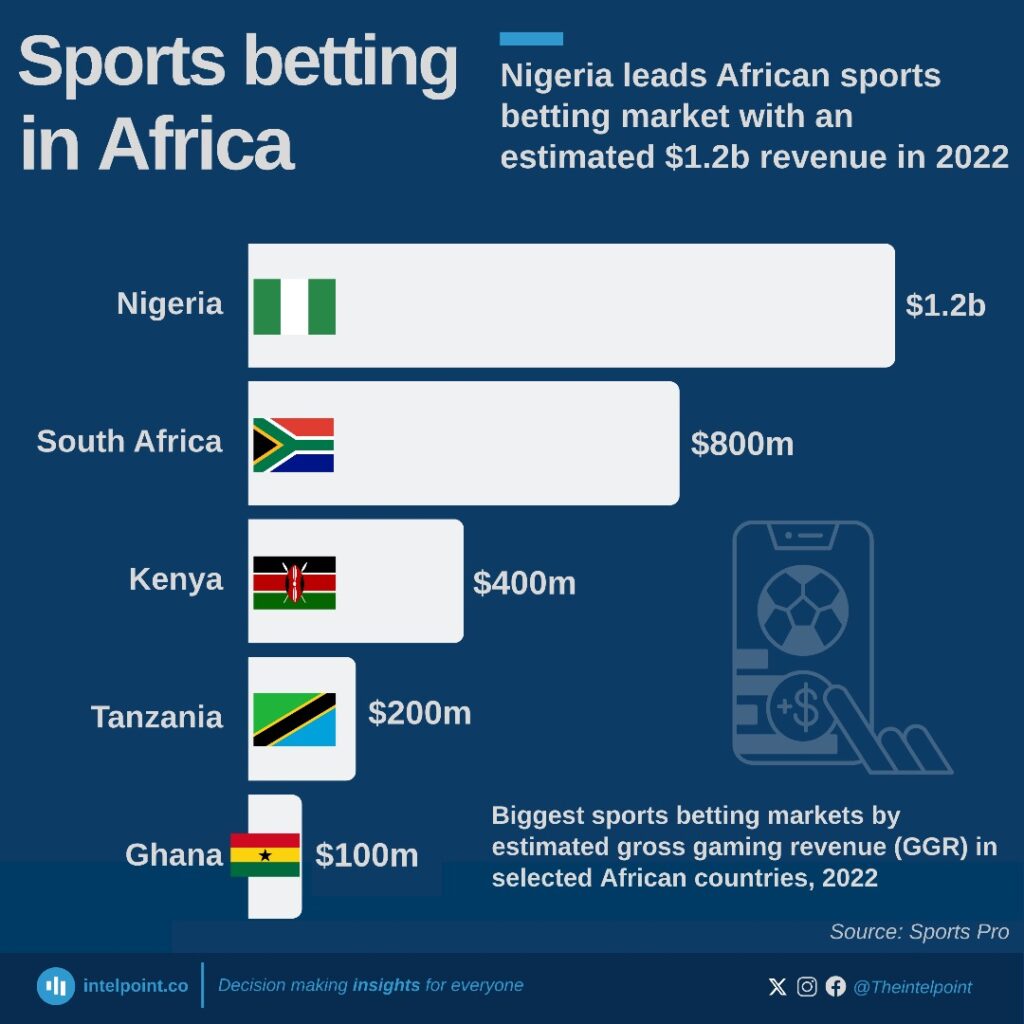

The statistics convey a clear picture of the proliferation in the African market. Nigeria ($1.2b) and South Africa ($800m) are the biggest sports betting sites on the continent per estimated gross gaming revenue. This high participation rate — also in Kenya, Tanzania, and Ghana — has culminated in considerable sponsorship opportunities, with betting corporations seeing sports as their primary marketing medium.

In South Africa, Betway obtained the title sponsorship of the Premier Soccer League in a three-year contract worth around R900 million (£38.3 million), making the league the “Betway Premiership”. This transaction was touted as the most significant investment in South African sport, underlining betting companies’ financial influence in the continent’s sports scene.

Nigeria provides another interesting case study — Bet9ja sponsors Remo Stars, the Nigeria Premier Football League 2025 winners. With a population of over 200 million, it has an estimated 168.7 million bettors and a participation rate of 71%, making it an attractive market for betting companies seeking sports partnerships. In Kenya, there is a massive 79% participation from a population of 57.5 million. Tanzania and Ghana both record 56% participation each.

Jobs, taxes, and development

As highlighted by the above peculiar cases, the influx of gaming funds into African sports has resulted in tangible economic gains. This arrangement has provided vital financial lifelines to sporting organisations battling funding issues. League sponsorships have helped to increase infrastructure, player compensation, and production values for television broadcasts.

Kunle Soname, Chairman of Bet9ja, one of the major betting brands in Nigeria, established a 5,000-seater Remo Stars Stadium in the country’s southwestern region. Considered one of the best stadiums in Nigeria with top-level infrastructure, the arena’s location at the grassroots has helped young athletes, particularly those in remote communities, access the relevant facilities required for skill improvement.

Another key benefit is job creation. The betting sector has generated thousands of direct and indirect jobs across the continent, ranging from technology developers and customer service representatives to marketing specialists and retail salespeople. The establishment of betting shops, for instance, offers employment in local communities. What’s more, casinos and resorts are renowned across several African countries as tourist destinations. One such place, South Africa’s Sun City Resort, home to gambling and entertainment, attracts tourists from around the globe and contributes to the nation’s tourism-related proceeds.

Tax revenue contributions have also been significant, though this remains a contentious topic. Governments across Africa have recognised the prospect for large revenue streams from the betting industry, with some countries imposing specific betting levies. Kenya, for example, has collected approximately Sh100 billion in gambling taxes since 2018.

Viewership and engagement have increased due to betting-sponsored platforms democratising sports access. Through partnerships and streaming services offered by betting companies like 22Bet and MercuryBet, African viewers can now watch formerly inaccessible international matches and leagues live via mobile devices, expanding the sporting atmosphere for fans throughout the continent.

Vulnerable populations and gambling addiction

Despite its economic advantages, the rise in betting sponsorship comes with concerns, one of which is that gambling addiction has spiked astronomically in Africa. Sports sponsorships and betting ads have become so common that they help to normalise gambling, especially among the youth, who constitute a large percentage of sports audiences.

According to Daily Maverick (SA), a study by the South African research firm Infoquest revealed that young people in the country who gambled online and on sports did so an average of eleven times per month. Additionally, 39% of young gamblers used their earnings to gamble again, and 30% stated they were gambling with money they didn’t have. Similarly, in 2019, Kenyan punters staked Sh30 billion in just one month. Two years later, a 2021 GeoPoll survey revealed that 84% of Kenyans bet regularly, with one-third doing so daily.

Sports viewing regularly exposes the audience to betting content, which has been shown to establish psychological links between gambling and entertainment. The line between gambling promotion and sports entertainment is blurred when betting commercials are conveyed before, during, and after football games, as well as when the names of betting organisations are displayed on the stadiums.

The situation is especially alarming in countries with deficient regulatory systems. Unlike European markets, where advertising limitations and consumer protection measures are becoming more stringent, many African countries do not demonstrate extensive regulatory control of betting sponsorship and marketing practices. This regulatory loophole exposes customers, particularly vulnerable populations, to potentially addictive gambling practices.

The industry has grown thanks to mobile technology, making betting more accessible and possibly more addictive. Given how simple it is for people to place bets using their mobile devices and the continual barrage of betting ads from sports sponsorships, gambling may easily become a problem, if it is not already one.

The regulatory challenge

It is very important for African governments to find the right balance between fostering economic growth through the betting sector and shielding their citizens from potential harm.

Some nations have begun to apply more rigorous policies. Kenya recently increased winnings taxes from 12.5% to 15% following an increase from 7.25% to 12.5% within one year. And this was despite industry protests and worries about driving betting underground. With the recent tax hike, the Kenyan government hopes to reconcile revenue collection with its attempts at curbing excessive gambling.

While South Africa has adopted more extensive gaming legislation, Nigeria’s approach offers broad state-level regulatory authority, particularly in Lagos, following a Supreme Court decision affirming state jurisdiction over gambling regulation.

Going forward, legislators’ major concern will be finding ways to ensure that regulations are sustainable and preserve the economic benefits of betting sponsorships without compromising proper consumer protection.

The way forward

As African sports and the market mature, the relationship between betting enterprises and sports organisations will likely shift. Though these collaborations provide vital resources for sports development on the continent, the social costs and regulatory issues deserve careful analysis and proactive regulation.

The controversy over betting sponsorship in African sports will persist for a while longer. And as awareness of compulsive gambling rises, betting sponsorship could come under further scrutiny, just as tobacco and alcohol sponsorship did decades ago.

Whether betting corporations should be heavily restricted from African sports is really not the most pressing issue here. What demands more focus is how these ties can be managed to preserve benefits while reducing risk. This approach will vary by country and context, but the need for critical, evidence-based solutions to this problem has never been so evident.