From 2000 to 2015, the average human attention span reportedly decreased by nearly 25%, such that a goldfish, with an attention span of nine seconds, averages more than a human at 8.25 seconds.

While the Internet is often cited as one of the precipitating factors of this condition, the rise of TikTok, Instagram Reels, and similar social media platforms/features has further contributed to or accommodated this supposed decline in human attention.

In this feature, we examine the implications of this emergence on sports video content in Africa, looking at how it affects sports consumption in the region.

Mobile-first infrastructure

Entertainment (including sports) consumption in Africa differs significantly from that of the rest of the world, particularly due to differences in Internet access. Home broadband — the wired, high-speed Internet common in North America or Europe — is a rarity in African homes.

PwC’s Africa Entertainment and Media Outlook 2024-2028 indicates that, in Nigeria, only 5% of households have a subscription to a fixed broadband, while usage stands at 10.4% in Kenya and 46.3% in South Africa. In contrast, mobile adoption has risen.

The PwC report projected that 4G will overtake 3G in Kenya and South Africa by the end of 2024, whereas in Nigeria, this is expected by 2026. This shows that mobile devices have evolved into a major, if not primary, means of accessing all forms of content.

Consequently, what could be described as a mobile revolution has democratised access to sports content. For example, Vodacom in South Africa introduced an affordable cloud-based phone at just R249 ($14). This device comes preloaded with apps like YouTube and TikTok, and is designed to help users easily migrate from older networks to 4G.

This enhanced connectivity, enabling better streaming and more interactive video experiences, directly benefits the consumption of short-form sports videos.

With more people spending hours online and on social media through their phones, short-form video content ranging between 15 seconds and 2 minutes naturally emerges as the format of choice for millions of African sports fans.

Statistics show that short-form video content receives 2.5 times more engagement than long-form videos. This makes them the ideal medium for showcasing sports highlights, player reactions, and other content that many audiences in Africa and around the world crave.

Platform dominance and engagement patterns

TikTok plays a big role in short-form sports video content, with #football and #soccer hashtags accumulating 273 billion and 108 billion views, respectively, during AFCON 2022. #AfricanFootball has seen over 48.3 million views.

Notably, TikTok’s year-long partnership with the Confederation of African Football (CAF) in 2022 was the first of its kind. It enabled the social media platform to cover the highlights of major events, including the AFCON and WAFCON.

CAF’s official TikTok page has gained over 1.4 million followers, establishing itself as the continent’s footballing channel for video-based fandom. In an official announcement, the platform revealed how key this partnership will be in bringing “unmissable content to fans, both on the continent and across the globe.”

YouTube is also a major medium for sports video content in Africa. Nigeria accounts for over 300 channels with more than 100,000 subscribers and has 75% of its content consumed by audiences worldwide. South Africa’s content attracts 65% of viewers.

Interestingly, traditional broadcasters continue to adapt to the digital/short-form video content wave. Africa’s leading sports media house, SuperSport, delivers a more comprehensive coverage of events, including highlights, fixtures, results, and news, through supersport.com, which now increasingly focuses on shorter video outputs in line with features from other social media platforms.

The youth factor

The global short-form video content market is populated by individuals between the ages of 13 and 40.

While short-form video content is generally most popular in North America and Europe — and fast growing in Asia — it is also seeing rapid development in Africa, a region boasting a vastly young demographic profile.

The continent’s youthful population, particularly Gen Zs and millennials, is inclined towards digital and mobile platforms, thereby contributing to growth in sectors like over-the-top streaming (OTT) services and mobile gaming.

Nigeria has one of the fastest-growing Entertainment & Media (E&M) markets, driven by its population of over 230 million, with a median age of 18.1. The country’s predominantly young profile signals consumer potential for the E&M and sports industries.

The continent’s overall massive young demographic fits right with the consumption patterns of short-form video content found on platforms like Instagram and TikTok.

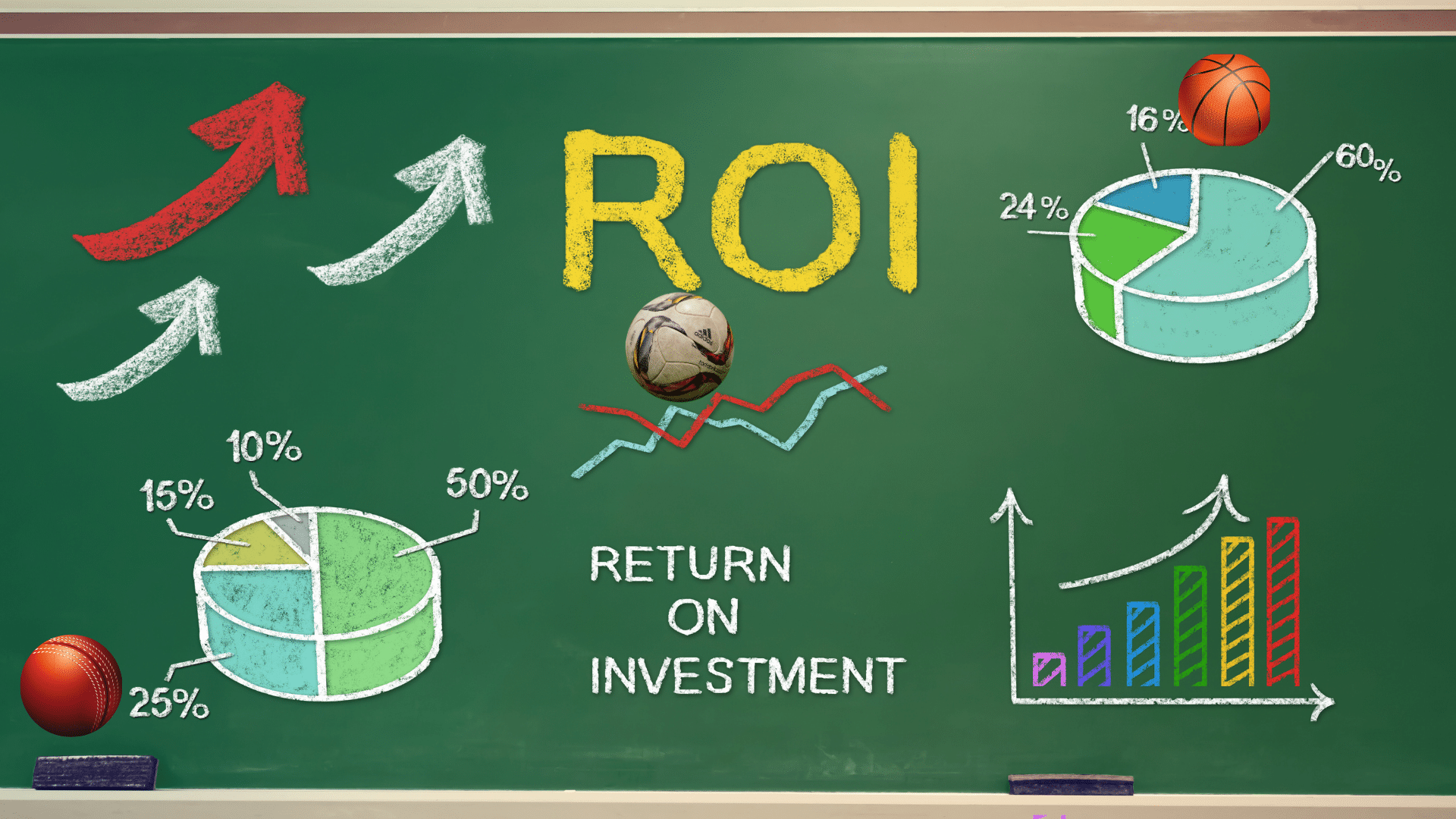

Monetisation and advertising opportunities

Worldwide ad expenditure on short-form videos is estimated to climb to $115.75 billion this year and $219.71 billion by 2030, with a CAGR of 13.68%. In line with the global trend, the financial potential of short-form sports video content in Africa appears promising.

According to PwC’s market data, Kenya is projected to have one of the fastest-growing Internet advertising markets between 2023 and 2028, with a CAGR of 17.4% growth scaling revenue from $163 million to $365 million. This digital advertising growth directly favours short-form sports video creators and marketing platforms.

Additionally, while 66% of marketers believe short-form content is most engaging, 27% of viewers are interested in sports clips or highlight videos, and 25.3% prefer sports matches or commentary.

Fans themselves, through the democratisation of sports content, can, as many already have, become content creators without having access to traditional broadcasting tools. Those on the African scene can also create and share viral content around key match moments, controversies, or player performances using basic mobile video editing features.

Short-form video content platforms like TikTok or YouTube Shorts have enabled, or better still, popularised the distribution and consumption of user-generated sports content. This grassroots content creation complements professional sports broadcasting and, at various times, has driven higher traction than traditional media.

Tech/AI integration and market projection

Generative artificial intelligence can streamline sports video content creation in several ways for African marketers.

It can help convert sports highlights into mini clips to analyse player performances for instant video generation, or to personalise sports video recommendations for different audience segments across Africa’s diverse markets.

The future spread of 5G across the continent will aid access to, as well as facilitate, higher-quality short-form video sports streaming and new interactive video experiences.

Given the global trajectory of short-form video consumption, sports video content creators/marketers, from both private and public institutions, can benefit hugely from the industry.

This appeal is backed by numbers, with 1.6 billion people (20% of the world’s population) now consuming short-form video. At the same time, ad spending across this format continues to rise.