Cricket and rugby remain unfamiliar to most African natives, who are more drawn to sports such as football, basketball, and athletics. However, the impact of these two supposedly estranged games on the continent is gradually increasing.

Cricket, for one, has well-established grounds in South Africa and Zimbabwe, with its footprint expanding into other terrains, including Nigeria, Kenya, and Uganda. The International Cricket Council (ICC) has supported projects in associate member countries, with Nigeria, for instance, hosting regional tournaments.

On the other hand, rugby continues to gain an edge, particularly with South Africa’s four World Cup victories, the latest of which occurred in 2019. Kenya and Uganda, too, make strides in rugby sevens (originally seven-a-side rugby), while other countries on the continent strengthen their XV teams.

Marketability and youth engagement

Perhaps the most encouraging sign for the long-term business potential of these sports is the growth in youth participation across the continent. In South Africa, where cricket is the third most popular sport behind football and rugby, development programmes endorsed by KFC have seen an impressive run for 15 years and counting.

More than 2.5 million children, including those with disabilities, have benefited directly from the system. A reported 123,000 children took part in the 2022/2023 KFC mini-cricket programme, supported by 10,901 volunteer coaches.

Similar efforts are ongoing in Nigeria at the school level, with a reported 200,000 children actively partaking in the sport. The nation’s cricket federation organises national U-17 championships annually, involving 33 male teams and 25 female teams across six geo-political zones in the country.

These initiatives have begun to yield results. In January of 2025, Nigeria’s Under-19 women’s team, in its first-ever World Cup match, defeated global giant New Zealand at the tournament in Malaysia. The country’s senior women’s team finished in third place at the African Games 2023.

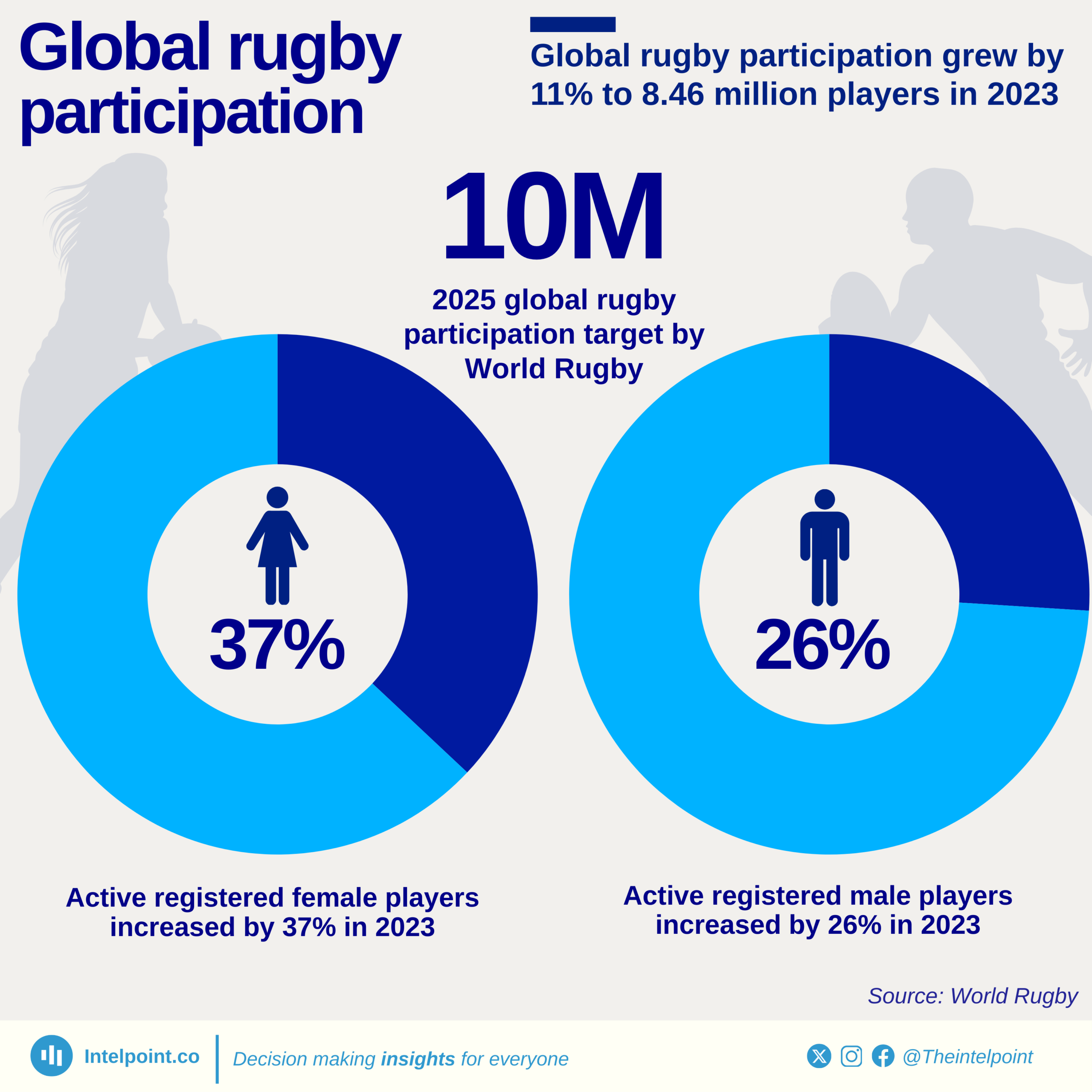

Global rugby participation statistics, on the other hand, show trends that favour African development. Involvement increased by 11% in 2023, with girls accounting for 24% of the 57% pre-teen players who took up the sport. Notably, Ghana, Nigeria, and Zambia are among the six nations experiencing strong growth.

The annual Kenya Varsity League also helps to push rugby forward in Africa, gathering sponsorships from local brands like SportPesa and Tusker.

Brand interest and sponsorship trends

Visibility for these sports is slow but rising, as non-traditional sponsors and major corporations have begun showing interest. South African Rugby Union (SARU), for instance, struck an agreement with the US investment firm, Ackerley Sports Group (ASG), to manage its media and sponsorship rights.

Kenya secured a Ksh 10 million ($77,400) deal with Kenya Breweries Limited (KBL) for the 2025 Kenya Cup. This sponsorship was aimed at boosting the atmosphere for the semi-finals and finals of the premier club rugby competition. Likewise, gaming brand SportPesa renewed its partnership in 2024 with the Kenya Rugby Union, pledging Ksh 84 million ($650,000) to the men’s national rugby 7s team ahead of last year’s World Rugby 7s series.

Besides breweries or betting brands, African technology companies are also investing in rugby. In Zimbabwe, Mukuru — one of Africa’s most renowned fintech brands — sponsors the country’s national rugby team as they pursue World Cup qualification.

In cricket, South Africa secured the Indian brand, Amul, as team sponsor for the ICC Men’s T20 2024 World Cup. Known for dairy products, Amul featured on the playing kit of the men’s national team. This achievement highlights the sport’s capacity to attract international commercial partners into the African market.

Outside of South Africa, however, sponsorship deals, particularly for women, are sparse. In Nigeria, despite the progress made in cricket in the past five years — with hundreds of thousands of girls participating in the sport — brands are yet to explore the commercial value in women’s cricket partnership opportunities. Uyi Akpata, President of the Nigeria Cricket Federation, reveals that with the proper funding, sub-Saharan Africa can reach one million girls annually. However, this level of outreach has not been achieved.

Broadcast and streaming opportunities

In the media terrain, cricket and rugby in Africa have seen some transformation in recent years. TV Media Sport agency was appointed to distribute broadcast rights on behalf of Rugby Africa, the continental governing body. This four-year contract marked a crucial step toward building a more structured and commercially viable future for rugby across the continent.

As the continent’s powerhouse in both sports, South Africa continues to draw in significant broadcasting deals. Foxtel Group has extended its agreement with the nation’s cricket federation to broadcast its Proteas Men’s and Women’s international matches in a multi-year deal from 2024-2025 onwards.

Despite both sports lacking wide-reaching continental coverage, interest is growing, even beyond traditional markets. International broadcasters, as seen in the case of South Africa, continue to explore the potential of cricket and rugby in Africa.

Assessing business potential

Despite certain indications of progress with cricket and rugby in Africa, several challenges hinder the fuller realisation of their business potential. Competition from larger sports, such as football, for deals, media coverage, and youth participation remains fierce.

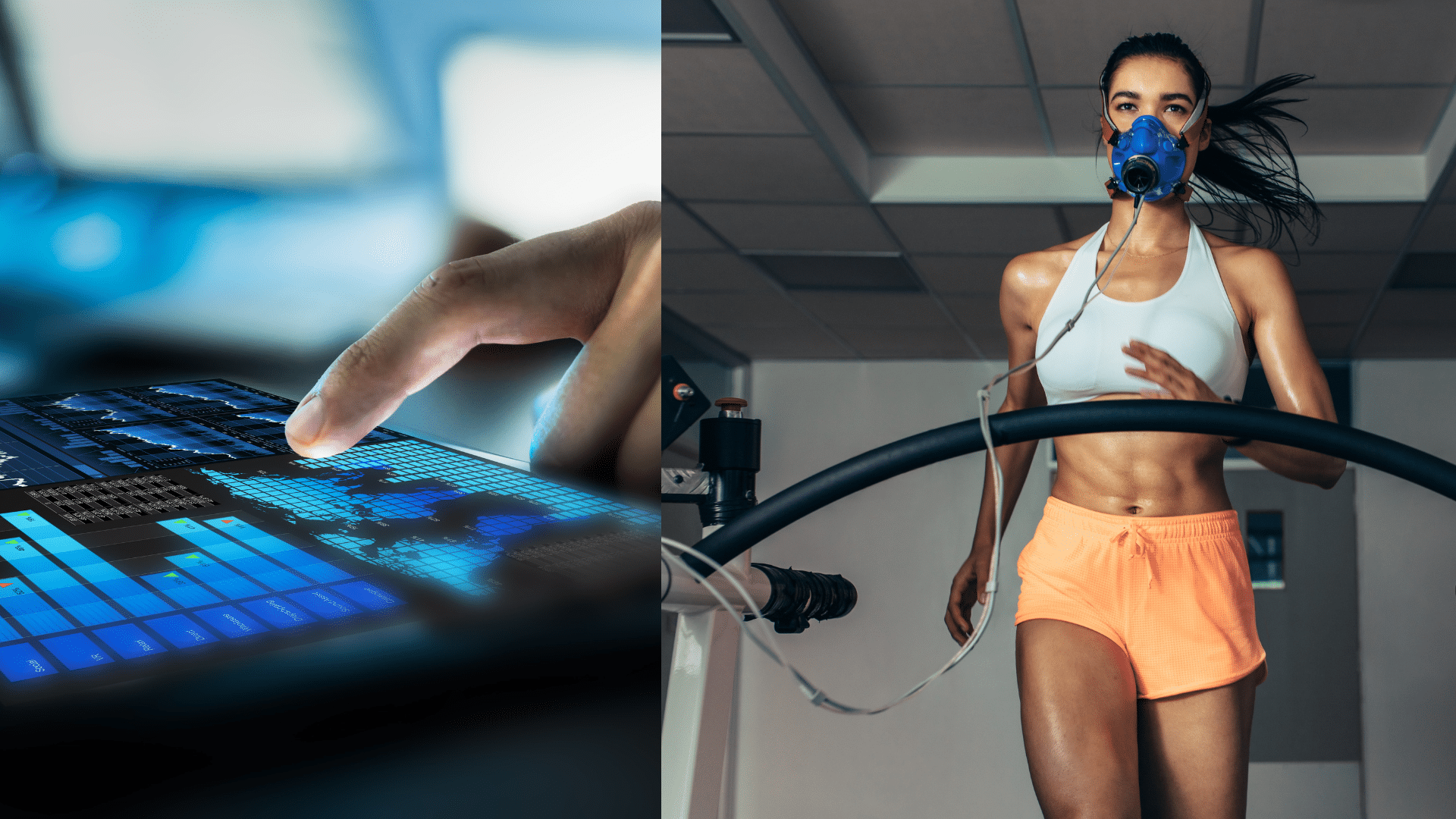

Additionally, infrastructure constraints in many African countries hinder their ability to host major international tournaments or develop professional domestic competitions. This is despite the rise of shorter format cricket — particularly T20 leagues — which offer opportunities for the continent. These formats require less infrastructure investment and can generate TV content that appeals to a broader, younger demographic.

Similarly, Rugby 7s offers accessible routes for new markets. Its inclusion in the Olympic Games has increased its global appeal. Now, with its fast-paced and short-duration format, it is well-suited for television broadcasting and live event attendance, even in developing markets.

While challenges may arise, they also present opportunities for strategic investors and partners to offer a long-term vision and substantial capital. Increasing youth engagement in both sports also provides sustainable growth foundations.

In the years ahead, as teams across Africa improve their competitive performance, their international profile and commercial appeal are likely to rise. If current progress — though varying across countries on the continent — in cricket and rugby is any indication, the integration of each more national teams into global tournaments will continue to drive broadcast value and sponsorship interest.